Flexible Offices are Moving to Secondary Cities in Response to Large Companies’ Need to Attract Talent

John Williams, Head of Marketing, The Instant Group

According to John Williams of The Instant Group, a partner of WORKTECH Academy, an international knowledge network on work and workspaces, companies around the world are using flexible offices more, with demand moving from large cities to the suburbs and secondary cities. The following is an excerpt from an interview with John, who explained about the background to this trend.

The real estate industry is becoming more service-led

The Instant Group (“Instant”) provides workspace solutions in more than 2,000 cities worldwide and has abundant data and knowledge on the flexible space market.

According to our latest research, for example, London has the largest number of flexible spaces, followed by New York. The markets in these two cities are growing rapidly, with an annual growth rate of nearly 20%. The growth in Asia-Pacific is also prominent, and people have high interest in the Tokyo market, which has the largest office size in the region. While New York currently has the largest desk rate (monthly fee per desk), Tokyo is showing the largest annual growth. The entire flex space market has continued to grow across the world, but there have been changes in the nature of the growth.

You may think that WeWork are the largest provider in this market, but they are only a tiny portion of what is a massive market made up of a lot of independent providers. The flex space market, which is expected to grow by 15% per year, consists of independent companies and SMEs, who supply a lot of space. So, it is very different to conventional workspace.

Many industries are now moving from asset-based work to service provision. Amazon is the largest retailer that does not have a store, and Netflix is the biggest film company that has never shown its films in a cinema. While car makers are struggling, closing down factories, car-rental companies are growing. The real estate industry, which is seeing a rise of flex space, is not an exception. Flex space currently accounts for around 5% of the office market in major cities around the world, but Instant expects that 40% of office demand by major companies will move to flex space.

Large companies are wishing to reduce their balance sheet

Why is the use of flex space accelerating among large companies? One of the backgrounds is the shortening of the business planning cycle, which has been seen since the financial crisis of 2008. As the average business planning cycle is currently five years, it is unreasonable to sign a 10-year office lease contract. Companies place importance on agility with the wish to improve the flexibility of their portfolio. The amount of time it traditionally took from the start of construction of a new office to its opening, which is around two years, does not suit the time frame of rapidly growing high-tech companies.

Furthermore, due to the global drop in vacancy rates and a rise in rent, the use of flex space, which reduces companies’ balance sheets by outsourcing office space, is rising in value. Flexible offices are increasing their presence as a solution that alleviates the risks and responsibilities companies face and reduces the time required before companies can use a workplace.

Moving to secondary cities where competent workers live

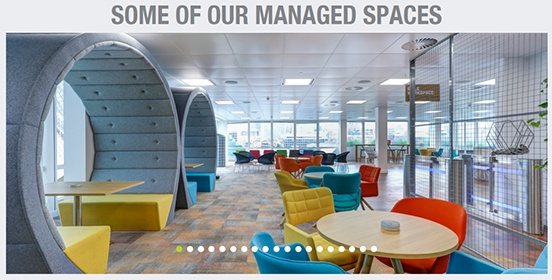

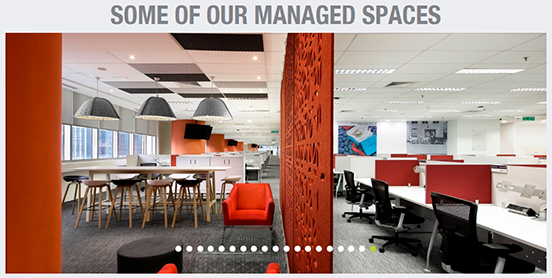

One of the dominant workspace trends over the next 20 years is de-organization facilitated by flexible working. The keyword is “choice.” Conventional real estate was pretty much selling the same product to the same client for the past 120 years. Neutral carpets, white walls. The workstyles of the workers working there were also the same. However, today’s flex spaces are radically different in their approach and provide a wide variety of options both in terms of location and style.

In terms of location, the share of global cities in the flex space market is gradually declining in recent years, and share is moving to secondary cities. For example, in the U.K. that will be Manchester and Bristol, in addition to London, and in Germany it will be Kiel and Nuremberg, in addition to Berlin.

This is partly influenced by the demand of large companies, who are the users of flex space. Large companies are setting up bases in semi-metropolises and the suburbs not only to avoid the soaring rent in global cities but also to attract competent workers. Workers are moving out of urban centers, where the rent is rising, to the periphery, resulting in a greater burden of commuting to the office in urban centers. Therefore, companies are signing up for suburban flex spaces which they intend to use as a relatively large-scale base to attract talented workers living in the area.

As an example, IBM signed up for a flex space that houses several hundred people in Bristol and succeeded in approaching IT workers living nearby. Bristol is a major city in England about 2.5 hours away from London by car and is a popular residential area. From this flex space, IBM looked for IT workers who would participate in a project. IT workers are becoming increasingly difficult to acquire year after year. In today’s situation where financial institutions and law firms are competing with Amazon over human resources, having an office in an area where a lot of talented workers live has become an effective way of attracting talent. Furthermore, flex space is also convenient in the sense that it can accommodate a flexible number of workers, since project-based hiring will result in many part-time workers such as freelancers and those working as a side job.

Of course, such trends of companies are two sides of the same coin as the trends of workers’ workstyles. A fixed, centralized way of working, which involves workers commuting to the central office in metropolises has become a thing of the past, and it has become common for today’s workers to have control over where and when to work. An example would be to concentrate meetings and other work that require multiple workers to gather in the same place in the middle of the week and work from home or a flex space nearby on Mondays and Fridays so that weekends can be spent fully on leisure or rest. Amid the trend of controlling work and life autonomously, workplaces near the home that can be used at the workers’ discretion are becoming requisite.

Property owners, investors, and space operators will have to provide more flexible space in secondary cities to cater to this demand. And that is where the market will be made. One of the most fascinating things about the flex space market is that it is very sensitive to market demand.

Companies are requiring both co-working and confidentiality

There is a misunderstanding about the flexible workspace model. It is about co-working, like the spaces provided by WeWork, which is a membership per desk, per month, but this extremely trendy model that analysts are obsessed about is actually only about 2% of the total flex space market. In contrast, the conventional serviced office is a kind of dinosaur and is no longer in need by anyone. A lot of companies want a hybrid of the two. They want the attractive and comfortable communal areas where people can co-work but also private office space with security and confidentiality.

Many operators are starting to provide managed offices as a way to address this need. It is a workspace solution customized for each company in which a single provider is in charge of the entire process from procurement and management. All costs including facility management costs are included in the usage fee. This is the most rapidly growing area at Instant as well. We have done it for big companies such as Amazon, Facebook, and Barclays. A rising number of companies is using managed offices not only for project offices or contact centers, but also for their head office.

The market will continue growing after brand consolidation

As I have explained so far, this huge market has continued to provide more options in response to clients’ needs, and now there are around 30,000 flexible spaces and more than 6,000 operators around the world. However, we think there will be a big consolidation of brands. That is the nature of the business. According to our data, the space of each flex office is getting bigger each year. This is because there are more 25-plus desk requirements by companies. Corporates are expected take up more space, so operators of flex space must procure larger floor area to cater to that demand. This could lead to a consolidation of operators.

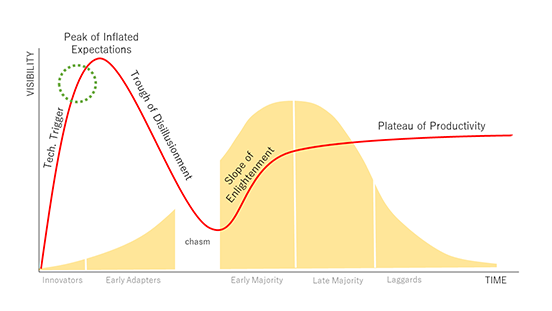

The chart shows the diffusion of an industry over time. We are currently up there at the green dot: just before reaching peak co-working excitement. Everyone gets crazy over this new market, and inevitably there will be a dip. We will be in a period of consolidation. Operators will calm down and there will be new rules, resulting in a stable market. But either way, the market will continue to change in response to demand.